The which insurance companies offer sr22 blog 8780

Not known Factual Statements About Financial Responsibility Insurance Certificate (Sr-22)

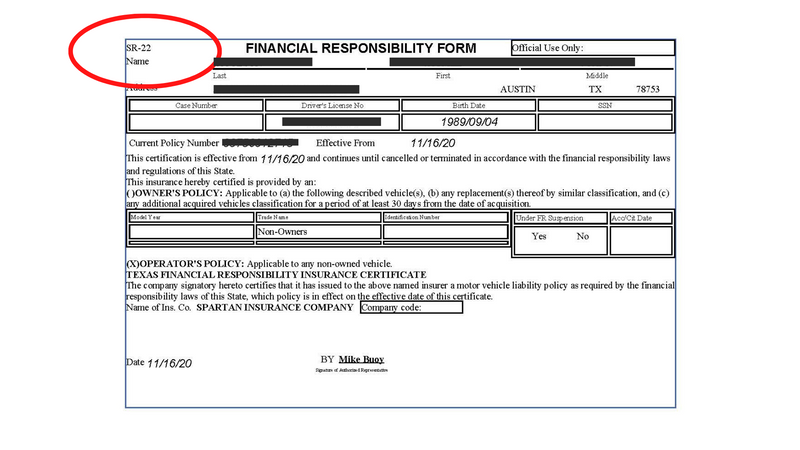

If you have just recently had your certificate put on hold or you are taken into consideration a "high danger" chauffeur, however you do not own an auto, you can still purchase this sort of insurance under the heading "non-owner insurance coverage". This indicates that if you rent out a vehicle or borrow a cars and truck from your good friend, you still have the insurance policy protection you are legally required to have.

Tough, but possible. (Mon-Fri, 8am 5pm PST) for a or load out this form: The majority of the time you will figure out that you need this insurance when you are attending a management court hearing after you have actually had your license taken away or at encountering a probationary driving period.

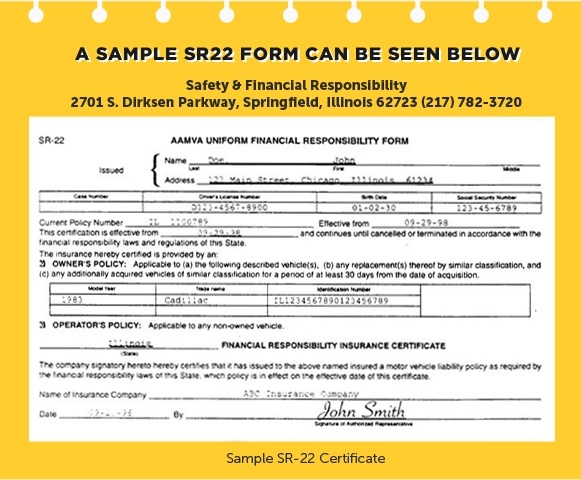

At this factor, you, as the chauffeur in inquiry, have to inform your insurance coverage company that the court has made Hop over to this website this request. At this factor your cars and truck insurance policy will file the type officially with your state DMV on your part.

Online submitted kinds are refined quicker than snail mail. sr-22. Keep in mind to request this from your car insurance policy instantly after a court or court has asked since there are state due dates for processing it, and if the DMV does not refine it in a timely manner due to the fact that they obtained it late, you are the one who gets punished.

So do not wait. Take right into account that it might take your DMV approximately 2 weeks to procedure as well as ask your insurance coverage how much time it will take them. In order to restore your certificate you have to pay a reinstatement charge and also any various other penalties connected with your driving record.

Fascination About Where Can I Find The Cheapest Sr22 Insurance In Nevada?

You should most likely to the DMV with the form in order to have your certificate renewed. You are required to maintain the SR22 insurance coverage for a designated quantity of time. Typically this time around is between one as well as 3 years but it is essential that you keep it as long as you require to stay clear of more costs - liability insurance.

Now, because your insurer is the one in charge of sending the real data, they take on this cost when the filing is done, then they will bill you independently or include the price to your next insurance coverage bill. In many cases you could be required to have SR-22 insurance policy for several years, in which situation you just pay a fee when for it to be filed the very first time.

Nonetheless, be suggested that if there is a lapsemeaning, you did not request the renewal to be refined on timethen you will have to pay once more since you will certainly require new proof of insurance coverage. division of motor vehicles. Generally talking, you will require to have this certification of protection for 3 years. The actual length of time is contingent upon: where you live and also what your state laws are, andwhy the courts needed this insurance coverage of you.

If there was a much less dangerous factor, it could be only 2 years. The coverage stays valid for as lengthy as you maintain your insurance plan. If, for any factor, you cancel this plan or there was a lapse in between renewals, your car insurance policy will certainly notify your state authorities.

For instance, if you are asked to have SR-22 for 3 years, yet after that you terminate your insurance plan after 2 years, the state will likely suspend your license if it had actually been previously put on hold. They will certainly after that push a metaphorical pause on that three year mark and also when you decide to purchase a brand-new insurance plan in the future, they will begin it up once more - sr22.

The Ultimate Guide To What Is Sr-22 Insurance Quotes?

The length of time you are called for by your state to lug the insurance policy can be extended if, during that time, you enter into an automobile crash or a web traffic offense. The courts can extend the moment you need this insurance policy, which can increase the expense of your insurance policy. The factor the expense increases is because extra offenses tells your insurance that you are a risky motorist - insurance.

If you select an AAMVA declaring digitally after that this will be automatically done at the end of your called for time. Any kind of insurance coverage carrier in any type of state can give this insurance coverage, but not all of them do.

bureau of motor vehicles insurance bureau of motor vehicles sr-22 insurance coverage

bureau of motor vehicles insurance bureau of motor vehicles sr-22 insurance coverage

sr-22 ignition interlock sr-22 dui insure

sr-22 ignition interlock sr-22 dui insure

If they will not cover you, there are alternate insurance suppliers such as,,, as well as. In order to obtain your insurance policy protection up to date, you will require to obtain a quote for SR-22 insurance coverage.

coverage insurance companies insurance sr-22 insurance deductibles

coverage insurance companies insurance sr-22 insurance deductibles

You can get a cost-free quote just filling up the form on the top of this web page, as well as in a couple of mins you'll compare several cost effective SR-22 insurance quotes. Relying on your state, and also the factor for your offense, you may have to file additional alternative forms - liability insurance. SR-21 Insurance policy, This is a comparable type however it shows that you have proof of vehicle insurance.

SR-50 Insurance coverage, If you reside in the state of Indiana this could be the alternate insurance policy you are required to carry. This set is similar and is implied to aid you get your licensed renewed after it has actually been suspended as a result of your infraction. (Mon-Fri, 8am 5pm PST) for a of a cheap SR22 insurance policy, or submit this form: (ignition interlock).

5 Easy Facts About Cheap Sr22 Car Insurance Quotes [Monthly Cost + Best Sr ... Shown

If the auto is not covered by crash and detailed insurance coverage, just make certain you can pay for to replace the car if an accident takes place. Other methods to save cash on your premiums so you benefit from economical SR22 insurance coverage is by going with a greater deductible. Your monthly price is reduced when you select a high deductible, however you'll need to pay even more out-of-pocket if you remain in an accident.

If they will not cover you, there are alternative insurance policy carriers such as,,, and also. In order to get your insurance policy protection up to day, you will require to get a quote for SR-22 insurance coverage.

You can obtain a totally free quote just filling up the type on the top of this web page, and also in a few minutes you'll contrast numerous affordable SR-22 insurance quotes. Relying on your state, and the reason for your violation, you may need to submit extra alternate types. SR-21 Insurance coverage, This is a similar form yet it shows that you have proof of vehicle insurance.

SR-50 Insurance, If you reside in the state of Indiana this may be the alternate insurance you are called for to bring. This one is similar and also is suggested to help you obtain your qualified reinstated after it has been suspended because of your violation. driver's license. (Mon-Fri, 8am 5pm PST) for a of an economical SR22 insurance, or fill in this kind:.

However, if the automobile is not covered by crash and also comprehensive protection, just make certain you can manage to replace the cars and truck if an accident occurs. Various other methods to save money on your costs so you gain from cheap SR22 insurance is by going with a higher insurance deductible. Your regular monthly rate is lower when you choose a high insurance deductible, but you'll need to pay more out-of-pocket if you are in a mishap.

The smart Trick of What Is Sr-22 Insurance And How Much Does It Cost? That Nobody is Discussing

Bigger firms consist of,,, and. If they will not cover you, there are alternative insurance suppliers such as,,, and. These are the top 10 insurance coverage service providers for. sr-22 insurance. So as to get your insurance policy protection up to day, you will require to get a quote for SR-22 insurance policy.

You can obtain a free quote simply filling up the type on the top of this page, as well as in a couple of mins you'll contrast multiple affordable SR-22 insurance coverage quotes. Depending on your state, and also the factor for your offense, you could need to submit added alternate forms. SR-21 Insurance, This is a similar kind yet it demonstrates that you have evidence of auto insurance - ignition interlock.

SR-50 Insurance, If you stay in the state of Indiana this might be the alternative insurance policy you are required to carry - insurance. This set is similar and also is indicated to assist you obtain your certified renewed after it has been suspended as a result of your offense. (Mon-Fri, 8am 5pm PST) for a of a cheap SR22 insurance, or complete this type:.

Nevertheless, if the vehicle is not covered by collision and also extensive protection, simply see to it you can manage to change the vehicle if an accident takes place. Other ways to save money on your premiums so you profit from affordable SR22 insurance policy is by going with a greater deductible. Your monthly rate is reduced when you select a high insurance deductible, yet you'll have to pay more out-of-pocket if you are in an accident - insurance coverage.

Bigger business consist of,,, and also. If they will not cover you, there are different insurance coverage providers such as,,, as well as. These are the top 10 insurance policy companies for - department of motor vehicles. To get your insurance policy coverage approximately day, you will need to obtain a quote for SR-22 insurance coverage.

Examine This Report on Esurance Car Insurance Quotes & More

You can obtain a free quote just loading the kind on the top of this web page, and in a couple of minutes you'll compare numerous budget friendly SR-22 insurance coverage quotes. Depending on your state, as well as the reason for your violation, you might have to submit additional alternative forms. SR-21 Insurance coverage, This is a similar kind yet it demonstrates that you have evidence of auto insurance.

SR-50 Insurance, If you stay in the state of Indiana this may be the alternate insurance you are called for to lug. This set is similar and also is meant to help you get your accredited renewed after it has been put on hold due to your offense. (Mon-Fri, 8am 5pm PST) for a of a low-cost SR22 insurance policy, or complete this form:.

If the vehicle is not covered by collision and extensive coverage, simply make sure you can pay for to change the cars and truck if a mishap takes place. Other methods to conserve money on your premiums so you benefit from cheap SR22 insurance policy is by choosing a higher deductible. Your monthly price is reduced when you choose a high insurance deductible, however you'll need to pay more out-of-pocket if you are in an accident.

If they will certainly not cover you, there are alternate insurance policy companies such as,,, and. In order to get your insurance policy coverage up to date, you will need to get a quote for SR-22 insurance policy.

You can get a cost-free quote simply filling up the kind on the top of this web page, and also in a couple of mins you'll contrast several inexpensive SR-22 insurance coverage quotes. Relying on your state, and also the reason for your violation, you could have to file added alternative types (ignition interlock). SR-21 Insurance policy, This is a comparable kind yet it shows that you have evidence of vehicle insurance policy.

The Ultimate Guide To Cheapest Florida Non Owner Sr22 Insurance

SR-50 Insurance policy, If you live in the state of Indiana this could be the alternative insurance policy you are needed to bring. This set is similar and is indicated to help you get your accredited renewed after it has actually been suspended due to the fact that of your offense. (Mon-Fri, 8am 5pm PST) for a of a low-cost SR22 insurance coverage, or complete this form:.

https://www.youtube.com/embed/SJPs1ItT9U0

If the automobile is not covered by crash as well as extensive insurance coverage, just make certain you can pay for to replace the cars and truck if an accident occurs. Other means to conserve cash on your premiums so you gain from inexpensive SR22 insurance is by choosing for a higher deductible. Your regular monthly rate is lower when you select a high deductible, yet you'll need to pay more out-of-pocket if you remain in a crash.

The Facts About How Long Do I Need Sr22 Insurance? Revealed

division of motor vehicles sr22 insurance companies insurance companies bureau of motor vehicles

division of motor vehicles sr22 insurance companies insurance companies bureau of motor vehicles

You do not desire the state to withdraw your vehicle driver's permit or your lorry's registration, which is the precise means they'll penalize you for this (motor vehicle safety). What Happens If I Do Not Have SR22 Protection? The state Division of Electric motor Automobiles will be informed by your insurance coverage firm if you do not have the correct insurance coverage needed for an SR22.

On top of that, you may have to pay fines as well as penalties relying on the state regulation. department of motor vehicles. Always make certain you're up-to-date on your insurance repayments, so if you slipped up and stopped working to pay the revival charge for your plan in time, you'll need to call the provider of your car insurance policy asap to get this dealt with.

You ought to obtain quotes from a selection of insurer as well as contrast them. Remember too that you might have to look at several auto insurance policy companies prior to you find what's suitable for you - bureau of motor vehicles. The more auto insurance business you inspect, the most likely you'll discover the very best prices for you.

Doing this before obtaining quotes indicates you might have to pay more ahead of time, but it deserves it due to the fact that this will certainly conserve you from having actually protection affixed with an expensive rate tag. Among the most efficient ways individuals can obtain less expensive rates is by shopping about and comparing various brands' deals on their sites or with call.

The Basic Principles Of Sr-22 Information : Oregon Driver & Motor Vehicle Services

Suppose I Need SR22 Insurance Policy But Relocate or Browse Through An Additional State? As stated in the past, there are 8 states that don't make use of SR22 certifications to restore licenses. Each of those 8 states, however, has its own one-of-a-kind matching of the paper. You will never ever see a state without an SR22 or something similar.

Moving from one state to one more can lead to needing the very same level of responsibility as if your traffic offense had actually been dedicated there. The method this functions can vary relying on what sort of offense was devoted, yet normally nationwide insurance coverage will certainly be needed for out-of-state filings.

In most cases, filing an SR-22 insurance certification with the state is the only thing standing in your means of obtaining your chauffeurs accredit reinstated. motor vehicle safety. In various other instances, there might be extra needs, such as attending a chauffeur's training course or alcohol understanding classes prior to you can obtain your certificate back.

You can get the sphere rolling, nevertheless, by beginning the procedure of finding SR-22 insurance coverage. Not all insurer use SR-22 insurance policy, yet there are plenty who do, so don't get discouraged. It's recommended that you do some auto insurance coverage contrast purchasing to make certain you are obtaining the most effective cost - division of motor vehicles.

Louisiana Sr22 Insurance Information Can Be Fun For Everyone

, as far as the automobile insurance firm is concerned. The pricey part is the obligation insurance that goes along with being called high risk.

How Lengthy Do I Need SR-22 Insurance? States have different requirements, yet typically, you'll require an SR-22 for around three years. If you have a major infraction, you might have to bring SR-22 insurance coverage for 10 years (motor vehicle safety). If your insurance lapses or gets suspended, the insurance policy company should notify the Department of Motor Cars.

This is rather basic: Call the insurance policy business and allow the representative understand that you don't need the SR-22 insurance coverage. It will be dropped. Obtain Assist with SR-22 Insurance Online Today If you need SR-22 insurance, you could really feel a little overwhelmed. The good news is, you can contact an insurance policy agent for aid.

Which Iowa Insurance Policy Companies Offer the Most Inexpensive SR-22 Insurance Policy? The insurance coverage policy of a chauffeur who needs SR-22 insurance coverage in Iowa is extra pricey than a common plan due to the extent of the infraction. A common policy with state minimum protection for a chauffeur with an SR-22 type because of DUI is $587 per year typically - deductibles.

The smart Trick of What Is Sr22 Insurance & How Much Does It Cost? That Nobody is Talking About

When searching for affordable SR-22 insurance policy in Iowa, you will have to consider your choices. Money, Geek located that one of the most budget friendly firm for SR-22 Iowa vehicle insurance policy is State Farm, which uses a minimum protection plan that costs approximately $302 each year. Travelers, on the various other hand, is the most pricey SR-22 insurance provider in this state, at approximately $1,120 per year.

bureau of motor vehicles deductibles ignition interlock motor vehicle safety sr-22 insurance

bureau of motor vehicles deductibles ignition interlock motor vehicle safety sr-22 insurance

Declaring for SR-22 insurance policy comes with an one-time cost that costs around $25. Risky traffic offenses will revoke your qualification forever driver discounts, making SR-22 insurance a lot more costly. The price of insurance coverage for vehicle drivers who need to have an SR-22 kind differs depending on the seriousness of the violation.

Your cars and truck insurance coverage supplier will certainly file the SR-22 type on your part, yet you should check with your insurance company to see if it issues SR-22 forms (insurance). If it does not, you will have to locate a provider that does.

Prices will vary, they will certainly not be as high as a policy for vehicle drivers who require to have an SR-22. more info The extent of your conviction will establish just how long you will certainly need SR-22 insurance coverage in Iowa. insurance companies. In many cases, it is 2 years after the reinstatement of your permit.

The Buzz on Vehicle Insurance Requirements - Utah Dmv

ignition interlock driver's license coverage insure sr22 insurance

ignition interlock driver's license coverage insure sr22 insurance

Those that provide insurance policy protection for drivers with SR-22 in Iowa will likely increase your premium prices. Compare Vehicle Insurance Coverage Fees, Ensure you're getting the best price for your car insurance.

In Iowa, the average expense of non-owner car insurance coverage is $387 per year. Keep in mind that this rate can alter depending on the automobile insurance coverage company.

Increase ALLWhat is an SR-22 in Iowa? An SR-22 in Iowa is a requirement for a motorist dedicating a major driving offense, such as multiple website traffic violations or DUI. It is not a different plan however an added kind to verify that you have sufficient insurance coverage to abide by the state minimum requirement.

The average cost for a chauffeur with a clean document is $355 per year. That suggests SR-22 can increase the ordinary yearly costs by $232. Which company in Iowa is the cheapest for SR-22 insurance coverage? State Farm has the most inexpensive SR-22 insurance in Iowa. The typical cost of a State Farm plan with state minimum coverage for a motorist with an SR-22 is $302 annually.

Fascination About South Dakota Revoked & Suspended Licenses - Sd Dps

What Are the Reasons for a License Suspension? There are a variety of reasons why your certificate can obtain put on hold. Some examples consist of: A DUI or DWIReckless driving Driving without insurance coverage, Repeated relocating infractions Failing to pay child assistance, Severe relocating offense sentences For how long Does It Take to Restore a Certificate? The timeline for obtaining your permit restored varies substantially from state to state and the reason for the suspension (vehicle insurance).

If your certificate was suspended due to a moving infraction, you could be called for to take a protective driving class. Sometimes taking a driving program might assist you to obtain your permit back faster. Even if it is not called for, consider it will assist to lower your insurance costs, which will likely be higher complying with a permit suspension.

SR-22 insurance policy offers as proof to your state that you lug the minimum liability insurance protection required. coverage. Many insurance suppliers will certainly submit the SR-22 with the state on your behalf. The declaring period means the size of time required to hold continuous insurance policy coverage and also maintain the SR-22 on documents.

Our The New Sr-22 Requirements - Defending Kansas Drivers Ideas

What Do I Need to Know When it Comes to Obtaining Insurance after a Certificate Suspension? A license suspension can affect your insurance policy search in a number of ways. insurance coverage.

While it is always simpler to renew your existing policy, it may profit you to get in touch with different insurance suppliers after a permit suspension. underinsured. This will assist you establish which insurer will supply you the most effective rates. Get ready to hit the road once again with an auto insurance coverage plan from Vern Fonk.

AN SR-22 filing gives a warranty to the Missouri Department of Income MVDL that an insurance provider has actually released at least minimal liability coverage for the person submitting the filing; and that the insurer will alert the Missouri Secretary of State must the insurance ever gap for any kind of factor.

While these are the minimal amounts of obligation insurance, all insurance service providers use the choice to buy greater limits: $25,000 physical injury per accident $50,000 physical injury liability for all injuries in an accident, and $10,000 in building damages in one mishap Typically for one to 3 years, depending upon the reason that you are called for to have SR-22 coverage - sr-22 insurance.

Some Known Questions About Do You Need Sr-22 Insurance After A Dui? - Intoxalock.

This is called a non-owners plan. If you do not own an automobile you can still get SR-22 insurance coverage under a non-owner's insurance coverage. This sort of plan is not connected to a details lorry, it can be utilized for any type of automobile the SR-22 owner utilizes. If you own an automobile you have to buy a proprietor's policy and have your car linked to your SR-22 insurance coverage.

You can still keep your present insurance protection offered it satisfies the state requirements, and add an SR-22 filing to your current policy. An SR-22 plan is filed with the state to reveal that you have evidence of insurance. This makes it simple for the state of Missouri to track whether or not you have your necessary vehicle insurance policy - underinsured.

division of motor vehicles auto insurance driver's license auto insurance liability insurance

division of motor vehicles auto insurance driver's license auto insurance liability insurance

STL Insurance coverage Quit can handle this procedure for you. We shop the premier insurance policy providers to find you the cheapest cost SR-22 protection offered.

Your place, driving history, amount of miles you drive, and also debt score likewise go into identifying your car insurance coverage price for SR-22. You might get an SR-22 filing from any type of insurance coverage firm that provides it.

The Main Principles Of How A Dui Affects Your Auto Insurance (Sr-22 Requirements)

sr-22 department of motor vehicles deductibles dui sr-22 insurance

sr-22 department of motor vehicles deductibles dui sr-22 insurance

No. You need to call your insurance coverage agent to terminate your SR-22 filing once the allotted time is up, otherwise your plan will certainly proceed. Much more Information - division of motor vehicles.

https://www.youtube.com/embed/T-T3oGTTKno

In Wisconsin, You Need to Have an SR-22 for a Minimum of 3 Years There is a lot of confusion surrounding both SR-22s and also OWI offenses as a whole. An SR-22 is a form that your insurance provider submits with the DMV to license that you are insured after being identified as a high-risk chauffeur. Will Insurance Coverage Fees Stay High? Your insurance policy prices are most likely to stay high for regarding five years, depending on your provider.

Frequently Asked Questions - Iowa Dot for Dummies

I entered my insurance policy info online yet it says "pending"? This implies the insurance policy info you got in did not confirm with your insurance provider's data source immediately. It does not imply you are not guaranteed - underinsured. If you simply bought a new plan, it might take several days for the company to confirm it.

If you think the DMV has wrong info, please call NVLIVE The info on file can be looked into to confirm if you are called for to come into the office. This can mean we did not obtain a feedback from the registered owner within the (15) days reaction time or the insurance firm did not respond to our notice within their (20) day action time.

If there is a real gap in protection, you will certainly need to follow the treatments under Reinstatements & Penalties. You might not legally drive the automobile as of the suspension date detailed in the letter. I received a letter that says "disregard" or "retracted" (bureau of motor vehicles). The "neglect" letter indicates your insurance policy business has actually responded to the confirmation card sent out to you by confirming your insurance details.

This means your insurance coverage business verified coverage with the DMV, as well as nothing even more is needed. How does this relate to an insurance reinstatement? "SR-22 Insurance policy" is a Certification of Financial Responsibility that your insurance business will certainly submit with the DMV.

The Definitive Guide to What Is Sr-22 Insurance And What Does It Do? - Allstate

The penalty for the lapse of insurance might still use. I will certainly be auto parking my automobile and also might get "garage" insurance. Garage insurance is NOT obligation insurance, and therefore is not appropriate or reported to the DMV.

If you go down the obligation insurance coverage for any type of factor, you should cancel the registration as well as give up the permit plates. NVLIVE verification uses just to obligation insurance (auto insurance). See Permit Plate Surrender. Please consult your insurance coverage agent to validate whether you have liability protection. I'm having a conflict with my insurance coverage company/agent.

If your company cancels your plan, or if they will not submit your SR-22, you will certainly need to find a brand-new service provider. no-fault insurance. You are not allowed to submit the SR-22 with the DMV on your own. Will Insurance Policy Fees Remain High? Your insurance policy rates are likely to stay high for concerning five years, depending on your supplier.

Greet to Jerry, your brand-new insurance coverage representative (driver's license). We'll call your insurance provider, examine your current strategy, then locate the insurance coverage that fits your requirements and saves you cash.

The Basic Principles Of Louisiana Sr22 Insurance Information

If you have an existing plan you might be able to add your SR-22 to your plan via your insurance coverage company. If get more info your cars and truck insurance coverage had actually been canceled as a result of your current driving infraction, then you must indicate that you call for the SR-22 insurance coverage on your application kind. SR-22 is very comparable to standard auto insurance coverage, however, it will certainly be far more pricey.

driver's license insurance driver's license liability insurance liability insurance

driver's license insurance driver's license liability insurance liability insurance

Even if you are not a vehicle owner, you will certainly be called for to submit an SR-22 for non-owner condition. This is somewhat much less pricey than typical SR-22 but can be pricey. In Illinois, SR-22 insurance is required for 3 continuous years. If you do not restore your plan promptly, then your permit and enrollment will right away be suspended as well as you will begin the vehicle driver's certificate reinstatement process, including asking for a brand-new Illinois Drivers License Reinstatement Hearing.

If you vacate the state of Illinois you have the ability to waive your responsibility of submitting an SR-22 in the state of Illinois by submitting a testimony, however, it is incredibly most likely that you will certainly need to acquire SR-22 insurance in the new state. There are really couple of alternatives to SR-22 insurance coverage as the state has actually flagged you as an at-risk motorist, for that reason, the choices are unusual as well as costly.

You might deposit a surety or actual estate bond. To find out more visit the Assistant of State website.

Sr-22 Insurance Guide: State-by-state Info For 2022 - Wallethub for Beginners

It is essential to keep in mind that your need to keep the SR-22 insurance policy for the defined timespan or your permit is put on hold once again. motor vehicle safety. If your plan cancels or expires for any kind of reason the insurer is legitimately obliged to submit a SR-26, which informs the state of the plan termination.

motor vehicle safety sr22 coverage insurance companies sr22 insurance motor vehicle safety

motor vehicle safety sr22 coverage insurance companies sr22 insurance motor vehicle safety

When your current service provider does not release SR22 kinds it's time to do some research study. When wanting to buy an SR22 there are a couple of things to consider: 1) See to it the insurer is accredited to do service in the state of MO (department of motor vehicles). 2) Like with whatever else, experience issues.

Why do I need an SR22 if I do not have an automobile? Every state that requires an SR-22 declaring, calls for that you have actually the state mandated liability insurance coverage whether you are a vehicle owner or a non-owner (do not very own car).

By needing you to have SR22 insurance with or without a cars and truck, the state feels they are safeguarding the other motorists on the roadway. Where can I obtain an SR22? As discussed above, not all insurer offer SR22s., powered by Wessell Insurance Providers, llc, has been supplying auto insurance policy since 2006 (insurance companies).

Little Known Questions About How Long Does An Sr-22 Last? - Insurance Panda.

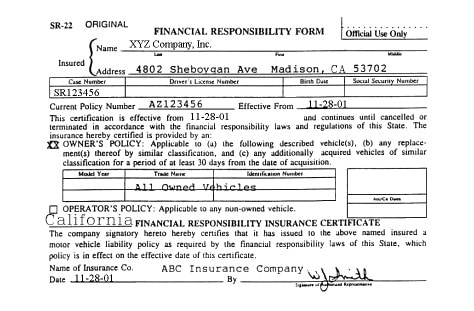

An SR22 is a type provided by an insurance business that educates a state that you have the minimum insurance coverage called for because state after getting your driving benefits back. It is not insurance policy or coverage, however a method your state guarantees your car insurance coverage is active. Trick Takeaways An SR22 is a kind your auto insurer sends out to the state so you can abide with court- or state-ordered demands.

no-fault insurance ignition interlock driver's license insure motor vehicle safety

no-fault insurance ignition interlock driver's license insure motor vehicle safety

SR22s can be filed with both standard insurance policy coverage plans and non-owner insurance coverage. This document verifies that you have actually satisfied your monetary duty for having the minimum responsibility insurance coverage.

You call your insurance coverage carrier, and they ought to issue you the kind once you have bought the minimum amount of auto insurance coverage - motor vehicle safety. You'll require to keep the minimum quantity of protection and see to it you have a present SR22 form through established by the state you live in.

The SR22 can cost regarding $25 in filing charges. SR22 may lead to an increase in insurance expenses by between 20% as well as 30%. An SR22 provided for uninsured driving is around $30 as well as can depend upon your credit scores.

What Is Sr-22 Insurance And What Does It Do? for Dummies

If you do not own a vehicle yet need to submit an SR22 because of a conviction, you'll require to ask your agent concerning a non-owner plan (insurance group). These policies cover your driving when you drive somebody else's vehicle or a rental and also expense much less than insuring an automobile. If you switch over insurance provider while you have an SR22, you'll need to apply for a brand-new SR22 before the initial strategy ends.

ignition interlock insurance group insurance group driver's license insurance coverage

ignition interlock insurance group insurance group driver's license insurance coverage

This type informs the state concerning the change. driver's license. Getting the declaring eliminated could reduce your rates on your insurance coverage. Just how Do I Learn if I Still Need SR22 Insurance Policy? You'll need to contact the agency that released the initial requirement to establish if the declaring is still necessary. The firm will certainly be either the state DMV or the court system.

In some states, if you terminate your SR22 declaring early, you could be required to restart the duration over once again, also if you were only a few days from the day it was established to end (insurance companies).

sr-22 sr22 coverage dui sr22 coverage insurance

sr-22 sr22 coverage dui sr22 coverage insurance

What is an SR-22? An SR-22 is a certificate of financial duty needed for some drivers by their state or court order. An SR-22 is not a real "type" of insurance policy, but a type filed with your state. This type works as evidence your vehicle insurance plan meets the minimum liability insurance coverage called for by state law.

Some Ideas on Faqs About Sr22 Insurance In California You Need To Know

Do I require an SR-22/ FR-44? Not everyone requires an SR-22/ FR-44. Laws vary from one state to another. Usually, it is called for by the court or mandated by the state just for certain driving-related infractions. : DUI sentences Careless driving Accidents triggered by without insurance chauffeurs If you need an SR-22/ FR-44, the courts or your state Motor Car Division will notify you.

Is there a charge associated with an SR-22/ FR-44? This is a single fee you need to pay when we file the SR-22/ FR-44. insure.

A filing fee is billed for each and every specific SR-22/ FR-44 we file. If your spouse is on your plan and also both of you need an SR-22/ FR-44, after that the filing fee will certainly be charged two times. Please note: The charge is not included in the rate quote since the filing fee can differ (division of motor vehicles).

Your SR-22/ FR-44 ought to be valid as long as your insurance coverage plan is active. If your insurance plan is canceled while you're still called for to lug an SR-22/ FR-44, we are needed to alert the correct state authorities.

Fascination About Guide To Sr22 Insurance In Idaho [What You Need To Know]

A Tennessee SR22 can be needed for an overall of 5 years from your date of suspension. If the Tennessee SR22 is applied for a total of 3 years (36 months) within the 5-year period, the SR-22 might be cancelled given it is not needed on any kind of various other suspension. If 5 years pass from the day of suspension prior to you renew your advantages, then the Tennessee SR22 would certainly not be required.

The SR-22 requirement begins on the date of the conviction. The SR-22 demand begins on the end date of the suspension. insurance.

The SR-22 need starts when you request the authorization as well as ends when the authorization expires. Please contact DMV to see if you require to get an SR-22. Out of State Declaring, Also if you live out of state, you should file an SR 22 with Oregon (if needed) before another state can provide you a vehicle driver license.

https://www.youtube.com/embed/O2rxbiylfwc

Any Colorado homeowner who has had their chauffeur's certificate revoked for driving intoxicated is required by the Department of Earnings, Department of Motor Vehicles (DMV) to obtain "Evidence of Insurance coverage" before reinstatement of their driving privileges. This type of insurance, called an SR-22, requires the insurance policy service provider to report any lapse in insurance protection to the Colorado Automobile Department.

Which Type Of Car Insurance You Need For Doordash? - An Overview

Non-owner plan is vehicle insurance for non-vehicle owners. This kind of policy covers if you are in an accident while driving a person else's cars and truck. sr22 coverage. You need to consider obtaining non-owner vehicle insurance if you borrow or rent out cars and trucks fairly typically or if you do not own an automobile but need to submit an SR-22 kind.

Non-owner car insurance supplies liability coverage to motorists who don't own an automobile but still need insurance protection (vehicle insurance). It does not cover any of your injuries or damage to the auto if you are responsible for a crash. According to Insurance. com's website evaluation, Geico($311) non-owner auto insurance policy is the most inexpensive auto insurance price, on average.

Non-owner car insurance supplies responsibility protection for drivers who need auto insurance coverage without a cars and truck. It pays for injuries as well as problems you create in a crash when you're driving an auto that another person owns. Non-owners cars and truck insurance coverage usually enters into play as a second insurance coverage if the automobile proprietor's insurance policy falls short in paying for the fixing and also clinical expenses.

As an example, allow's claim your non-owner's policy has $40,000 in residential or commercial property damage responsibility, and also the owner of the vehicle you're driving has $20,000 in home damages liability (underinsured). You borrow the car as well as trigger a crash with $30,000 in damages, leaving $10,000 to be paid by you (or your pal). insurance. Your non-owner's plan would cover the added $10,000 since your limits are higher and also you have protection.

dui insurance group sr22 coverage auto insurance driver's license

dui insurance group sr22 coverage auto insurance driver's license

If this holds true, your non-owner policy is likely to cost you greater than it would for a person with a tidy document. insurance companies. Drivers might be considered "risky" if their document consists of: A DUI sentence, Negligent driving, Numerous web traffic offenses within a brief time framework, Driving without insurance policy, If you're seeking certificate reinstatement, your state might call for higher liability restrictions than it provides for others (insurance).

Sr-22 Insurance, Division Of Motor Vehicles, Department Of ... Things To Know Before You Buy

In some cases, it may be needed to submit an SR-22 form with your state. The complying with table offers instance auto-insurance prices for vehicle drivers in Southern California.

You desire to contrast quotes zip code from at least three insurance firms to see that has the cheapest rate. You'll see just how significant service providers contrast on quotes for non-owners insurance policy, and also that you can conserve up to $300 by comparison shopping (insure).

division of motor vehicles driver's license auto insurance car insurance motor vehicle safety

division of motor vehicles driver's license auto insurance car insurance motor vehicle safety

What does a non-owner automobile insurance coverage policy cover? Obligation insurance policy covers injuries or property damages that you're lawfully responsible for as a result of a car crash (sr22 coverage).

Non-owner insurance coverage does not include the list below kinds of insurance coverages: Comprehensive, Accident, Towing repayment, Rental repayment, Your non-owner responsibility coverage can be utilized as second coverage if you obtain someone's car as well as are in a car crash; the automobile proprietor's automobile insurance policy offers as the key insurance coverage - coverage.

There are a couple of points that non-owner auto insurance coverage does not safeguard versus: You won't be covered if you're in a crash that triggers damages to the automobile you take place to be driving at the time - vehicle insurance. This suggests that if you borrow your pal's car and also enter a fender bender with one more vehicle, the lorry's proprietor can sue under their own car insurance coverage, or versus the other driver's cars and truck insurance coverage - car insurance.

The Buzz on Sr22 Insurance In Minnesota Explained - Policy Advice

vehicle insurance department of motor vehicles car insurance insurance sr22 coverage

vehicle insurance department of motor vehicles car insurance insurance sr22 coverage

Non-owner auto insurance just covers the individual who acquired it (credit score). If you are using your auto for job, like supplying plans, non-owners auto insurance coverage plan will certainly not cover you (insurance coverage).

Some auto insurance coverage business won't enable you to get a non-owner plan if there are way too many key motorists as well as automobiles listed on a plan. If a policy lists 3 chauffeurs and also 3 autos, and also you are just one of the vehicle drivers, you will certainly be provided as the primary driver on the 3rd vehicle and also will not have the ability to acquire non-owner cars and truck insurance policy.

Comply with these steps to buy non-owners insurance, Get in touch with an auto insurer agent about the insurance coverage. If non-owners sr22 insurance policy is required, give the representative with your state notice number (if appropriate-- not all states require this). Supply standard driving background. Receive info on offered business and insurance coverage price quotes.

This suggests that you have a financial interest in the vehicle and also will shed money if the car experiences damages - motor vehicle safety. It additionally lowers the danger of you devoting insurance scams. What is Non-Owner SR-22 Insurance? Non-owner SR-22 insurance coverage is a kind of vehicle insurance coverage for vehicle drivers who don't have a vehicle but are needed to have SR-22 insurance policy.

credit score driver's license liability insurance insurance sr22 insurance

credit score driver's license liability insurance insurance sr22 insurance

https://www.youtube.com/embed/n6LU20sAn9c

What occurs if I have non-owner cars and truck insurance and I acquire a cars and truck? Non-owner automobile insurance coverage policies do not cover you if you acquire a cars and truck. insurance companies.